ARLINGTON, Texas – The city of Arlington boasts a daunting self-imposed description of “The American Dream City.”

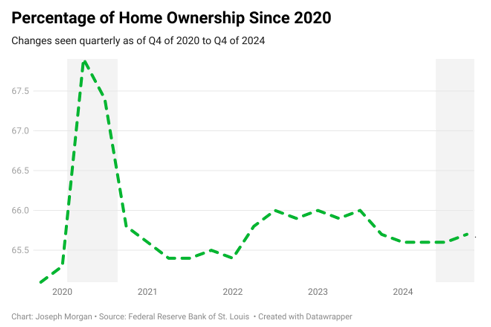

To many, the defining characteristic of the American dream is to achieve the status of homeowner. This dream reached a peak in Q2 of 2020, capping at 67.9% homeownership in America as a whole, according to data collected by The Federal Reserve Bank of St. Louis. Since, this percentage has seen a steady decline, resting now at 65.7% at the end of the fourth quarter of 2024.

This decline in homeownership is felt not only at the macro-level nationwide, but also at a micro-level within Arlington specifically. With the steady increase of property values and a heavily increasing property tax rate in Tarrant County, achieving the American dream is becoming more and more of a lost cause to many.

The inflation of property values has led to a stalemate between renters and their desire of owning property. Many residents who rent homes have seen price hikes in their monthly rent, leaving little to no allowance for a savings fund to reach their ownership goals. Renters are sacrificing more of their total income than ever toward their rent, especially those within lower-income groups.

According to the U.S. Census Bureau, “severely cost-burdened households have cost ratios of over 50%. Cost-burdened households have less money to spend on other critical needs such as food, transportation and child care.” That leaves nothing extra to spare for potential savings.

Even with the introduction of new construction developments in and around the Arlington area, this is doing little to assist the would-be homebuyers of tomorrow.

“If you look at north Arlington, that area is blowing up like crazy with new development,” Tanner Milner, owner of Apple Home Buyers, said. “But it’s an issue, too, because we don’t have much of any land left in Arlington, and that’s really part of the problem.”

Having been buying and selling homes in the DFW area for a little more than a decade, Milner has been able to see the ebb and flow and has developed a keen eye for what is going to come up on the horizon.

Milner explained that houses in Arlington are nigh impossible to keep on the market for prolonged periods of time because of “home-flippers” and rental developers who want to buy up any property in this emerging metro area and rent to the highest bidder.

“If I see anything come up here at all I’m going to grab it as quick as I can, because I know it won’t be there long,” Milner said. “I think eventually all these older homes are going to get knocked out and rebuilt, just like Dallas.”

And just like Dallas, Arlington is slowly but surely becoming a less economically available city for households netting less than $100,000 annually.